Masdar Planning New Green Bond Launch for 2025

Hyphen Web Desk

Masdar's previous green bond issuance in 2021, which raised $1 billion, marked a significant milestone in the region's financial landscape and positioned the company as a leader in sustainable finance. This bond was notably the first of its kind in the Middle East, reflecting a growing trend toward green financing within the region. The success of that issuance has laid the groundwork for future green bonds, as Masdar aims to capitalize on investor interest in environmentally friendly projects.

The upcoming bond will focus on funding renewable energy projects, including solar, wind, and other sustainable energy solutions. Al Ramahi indicated that the company is actively assessing various projects that align with its mission to support global efforts toward net-zero emissions by 2050. This aligns with the UAE’s broader strategy to diversify its energy mix and increase the contribution of clean energy to its overall energy supply.

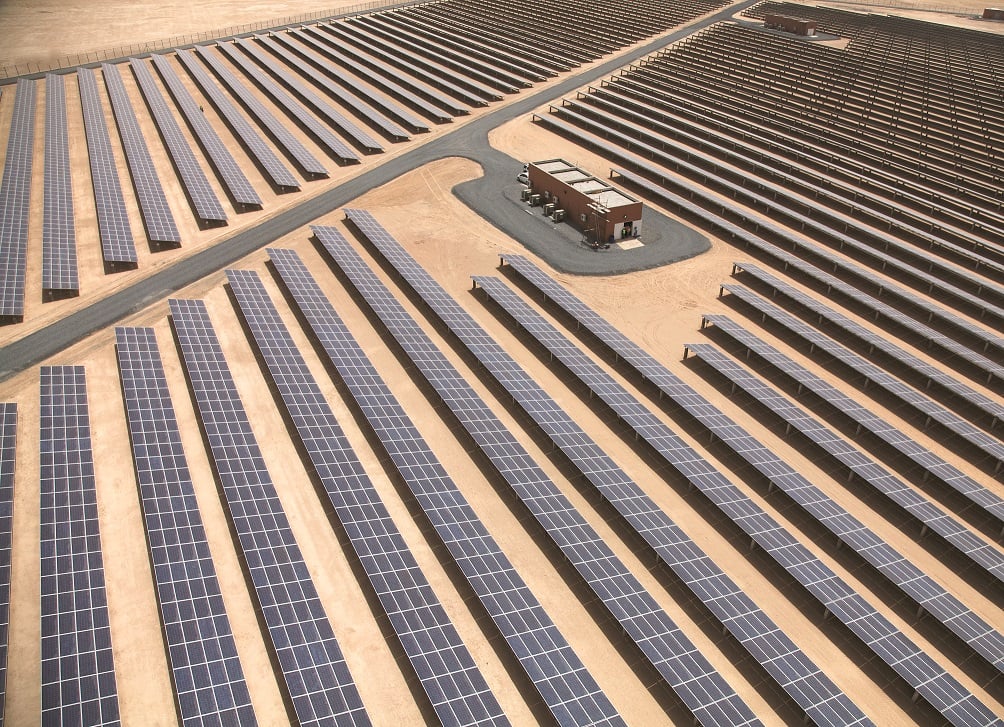

In recent years, the renewable energy sector has seen robust growth, fueled by increasing global demand for clean energy solutions and substantial investments from both public and private sectors. Masdar has played a pivotal role in this transformation, engaging in strategic partnerships and collaborations to enhance its renewable energy capabilities. Notable projects include the Noor Abu Dhabi solar plant, one of the largest solar plants in the world, and various offshore wind initiatives in Europe.

The green bond market has gained momentum, with numerous organizations worldwide issuing bonds to fund environmentally sustainable projects. The International Finance Corporation (IFC) reported that the global green bond market reached $1 trillion in cumulative issuance in 2021. This growth underscores a shift in investment strategies, with institutional investors increasingly prioritizing sustainability.

Masdar's strategic direction also coincides with the UAE's national priorities, particularly the UAE Energy Strategy 2050, which aims to increase the contribution of clean energy to the national energy mix to 50%. This ambitious goal underscores the commitment of the UAE to play a leading role in global efforts to mitigate climate change while supporting economic diversification.

Investors are showing growing interest in green bonds due to their alignment with sustainable investment goals and environmental, social, and governance (ESG) criteria. Masdar’s plans for a new green bond are expected to attract a diverse range of investors, particularly those seeking to enhance their ESG portfolios. Al Ramahi expressed optimism that the upcoming bond issuance will resonate well with investors looking to support projects that contribute to a sustainable future.

The regulatory landscape for green financing is evolving, with countries implementing frameworks to facilitate the growth of the green bond market. The UAE has taken significant steps in this regard, establishing guidelines to ensure transparency and accountability in green bond issuances. This regulatory support is crucial for fostering confidence among investors and promoting the growth of the green finance sector.

Masdar's initiative also highlights the importance of private sector involvement in achieving climate goals. As the world increasingly recognizes the need for urgent action on climate change, private companies like Masdar are stepping up to lead the charge in renewable energy development and sustainable financing. The company's commitment to green finance and clean energy projects positions it as a key player in the transition to a low-carbon economy.

As the 2025 launch date approaches, Masdar is expected to provide further details on the specific projects that the green bond will finance. The company is currently exploring various options to maximize the impact of its investments in renewable energy, ensuring that the bond issuance aligns with global sustainability goals. This initiative is part of a broader effort by the UAE to establish itself as a hub for green finance and renewable energy innovation in the Middle East.

The anticipated green bond is expected to enhance Masdar's reputation as a leader in sustainable finance and attract significant investor interest. Al Ramahi's emphasis on aligning the bond with the company’s broader mission underscores Masdar's commitment to supporting global efforts in combating climate change and fostering sustainable development.

التسميات:

#Syndication

مشاركة: