Canadian Investor Seeks $5 Billion for Emerging Market Climate Fund

Canadian asset manager Brookfield Asset Management is aiming to raise $5 billion for a climate-focused fund that will target emerging markets. The fund, called the Catalytic Transition Fund (CTF), was first announced in December 2023 at the COP28 climate conference in Dubai.

The initiative is backed by the United Arab Emirates (UAE) through its $30 billion climate fund, Alterra. Alterra has committed $1 billion to the CTF, which will be managed by Brookfield. The first round of fundraising for the CTF is expected to close by the end of 2024.

"The Catalytic Transition Fund represents a unique opportunity to leverage private capital to attract investment in clean energy and infrastructure projects in developing countries, " said Mark Carney, chair and head of Transition Investing at Brookfield Asset Management.

The CTF is the latest initiative by Brookfield as it expands its focus on sustainability. The company has already raised a record $15 billion for its first global transition fund in 2022, and a second fund launched in February 2024 has secured an initial $10 billion.

There is a growing recognition among investors of the financial viability of climate-friendly solutions, alongside the environmental benefits. The CTF aims to capitalize on this trend by offering investors the potential for competitive returns while also supporting the transition to a low-carbon economy in emerging markets.

A key feature of the CTF is that returns for the UAE's Alterra fund will be capped at a certain level, allowing other investors to potentially achieve higher risk-adjusted returns. Brookfield itself will also contribute at least 10% of the total capital raised by the CTF.

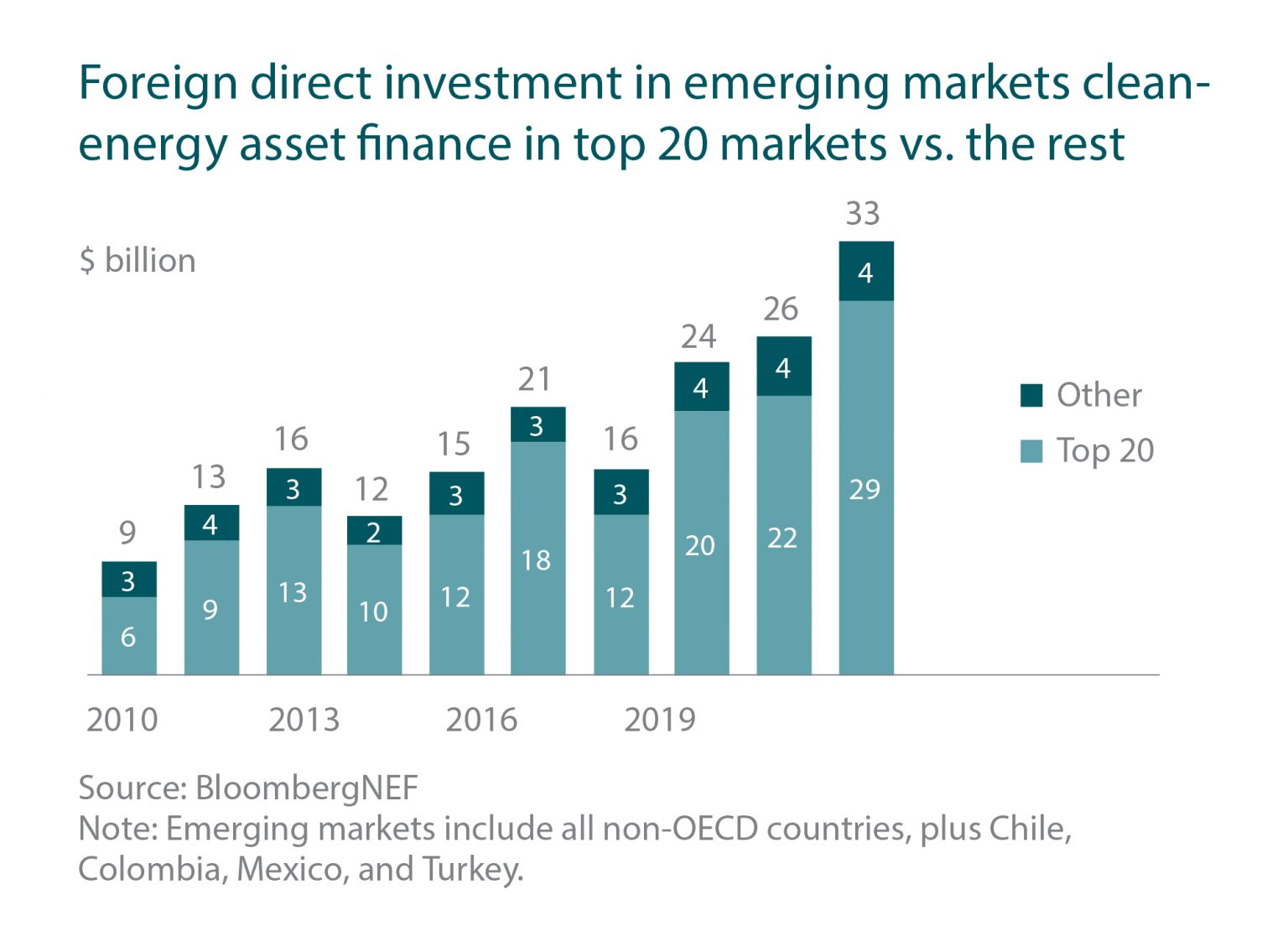

The focus on emerging markets reflects the significant potential for growth in clean energy sectors in these countries. Many developing economies are rapidly urbanizing and industrializing, which creates a strong demand for new energy sources. At the same time, these countries are often vulnerable to the effects of climate change. By investing in clean energy projects, the CTF aims to help emerging markets achieve their economic development goals while also reducing their greenhouse gas emissions.

The success of the CTF will depend on Brookfield's ability to identify and invest in high-quality clean energy projects in emerging markets. The company has a strong track record in infrastructure investing, and it will leverage this experience to select projects that are both financially sound and environmentally beneficial.

If the CTF reaches its $5 billion target, it would be a significant boost for climate finance in emerging markets. The fund could help to accelerate the development and deployment of clean energy technologies in these countries, which is essential for meeting global climate goals.

مشاركة: